This blog talks about Business Central State field customizations via...

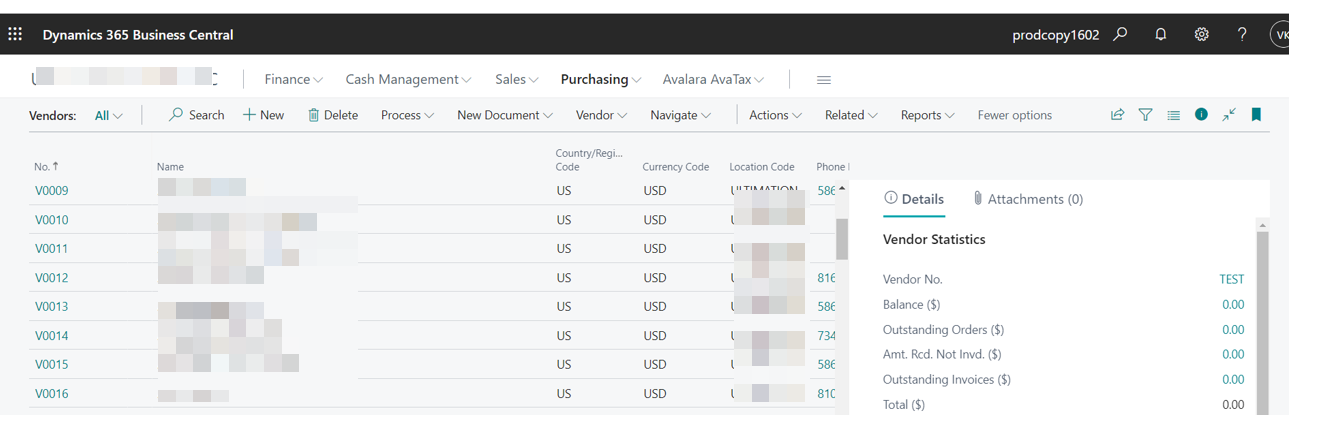

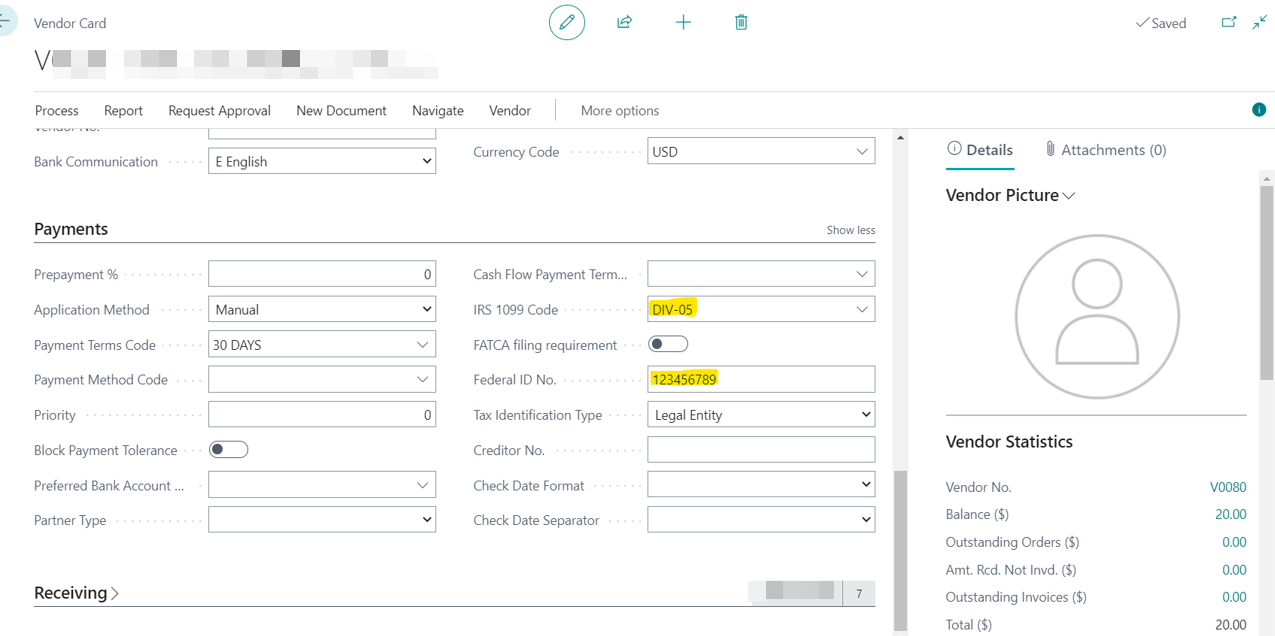

Read MoreEvery business has to process 1099 statements annually. To make the processing simpler for your accounts team, you should opt for Business Central 1099 Forms Setup. It is extremely user-friendly and it continues to update your vendor amounts all round the year.

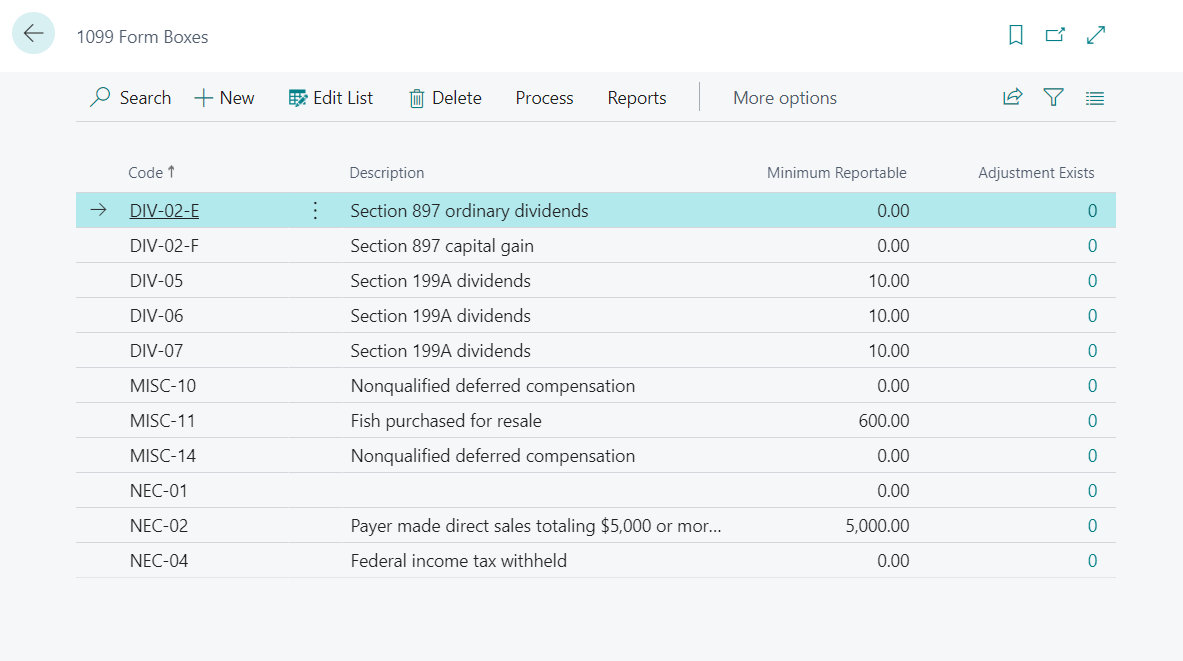

Business Central 1099 Forms Setup Boxes are automatically present in the system and they are updated through Job Queue Entries.

(NOTE: The 1099 reports will only be generated for all vendors above the minimum reportable amount for the assigned 1099 code, and the payments must be applied to the purchase invoices within the same calendar year.)

To review the minimum amounts of each 1099 IRS Code:

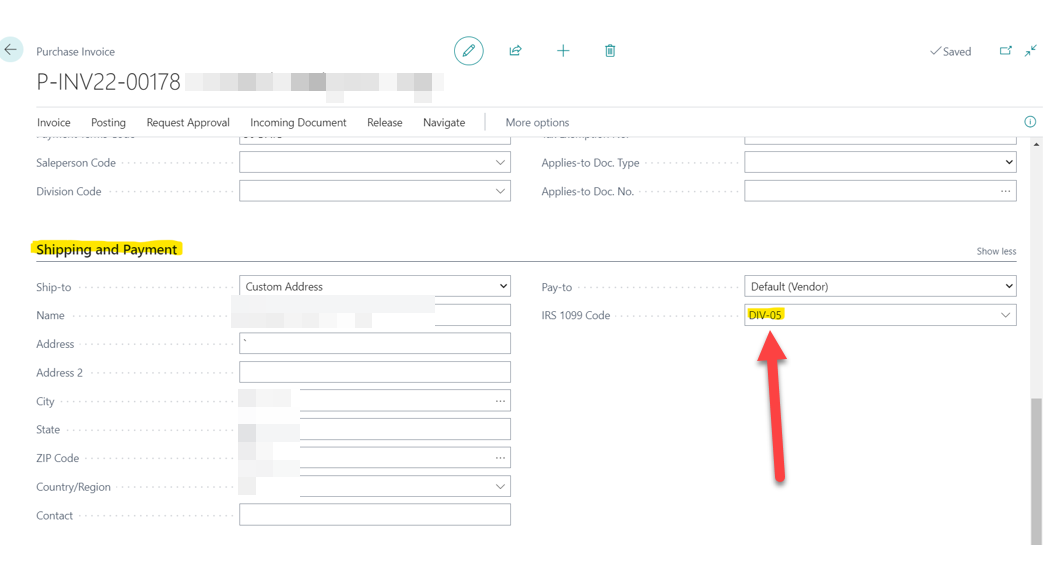

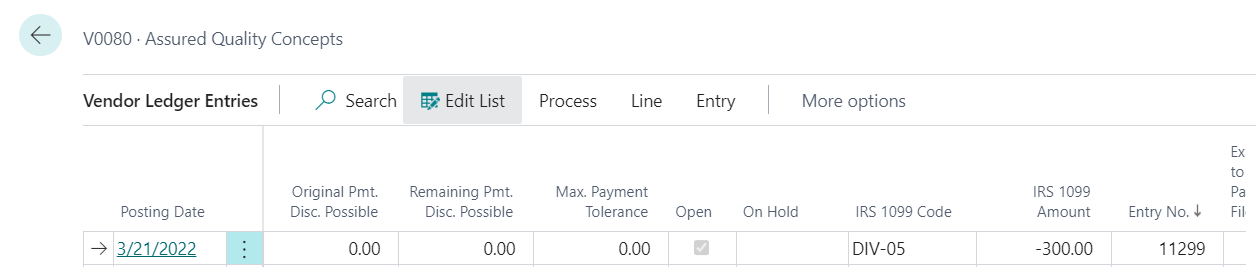

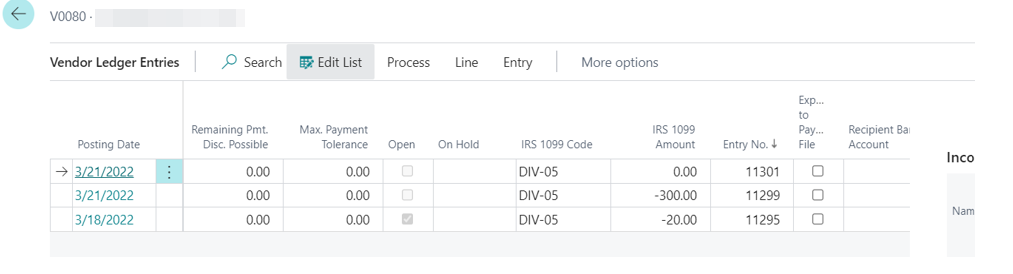

Corrections to vendor 1099 amounts can be done within the Vendor Ledger Entries Window. In this window, you can review the list of invoices and assign the IRS 1099 Code and amount for the total 1099 amounts to be reflected appropriately.

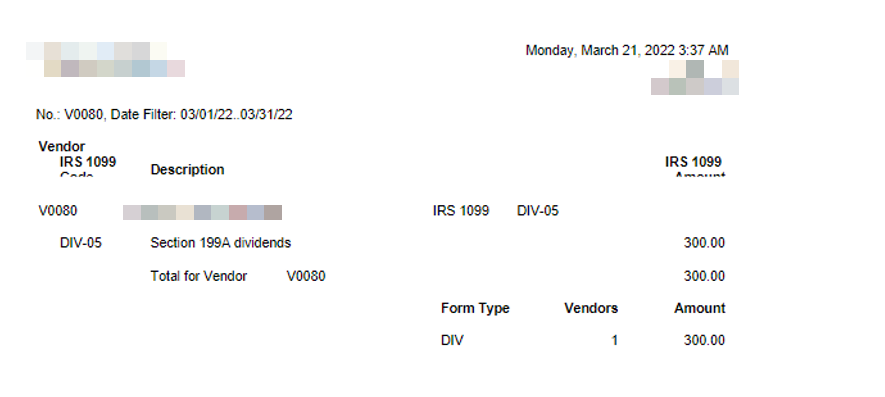

Once you are done correcting the transactions, you can run the “Vendor 1099 Information” report to verify the totals.

Business Central 1099 Forms Setup is extremely easy. 1099 forms is a great feature offered by Microsoft Dynamics 365 Finance as once you setup the a vendor as 1099 vendor, the amounts start to track in the software throughout the year. You can follow the steps given above to setup your forms quickly.

Reference:

This blog talks about Business Central State field customizations via...

Read MoreThis blog talks about Business Central Web Service APIs and...

Read MoreThis blog talks about Business Central Top 8 Unique Features...

Read More